If both people A and B have invested $1000 and they got $1050 back. That means both have earned equal profits of $50 each i.e., $1050-1000 = $50. But if person A has invested $2000 and received $70 and person B has invested $1000 and received $50 then who got a better return?

From a glance, it seems that person A is in a better position because he/she got $20 more than person B. But from a technical point of view, person B is in a better position because he got $50 on an investment of $1000, and person A got $70 on an investment of $2000. So, that means when there are unequal amounts we need to normalize the investment and returns to compare returns easily. So, for this purpose, there is a concept of finding the Rate of Returns. In this, we have two concepts Holding Period Return (HPR) and Holding Period Yield (HPY).

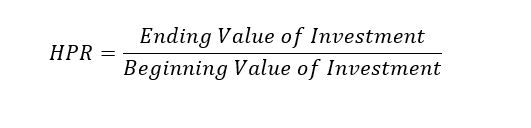

Holding Period Return (HPR)

It is the return for the period during which you own an investment i.e., the holding period.

Properties of HPR

HPR > 1, means that there is an increase in wealth i.e., a positive rate of return.

HPR = 0, which means that you lost all your money

HPR < 1, means that there is a decline in wealth i.e., negative return during the period.

Note: HPR is always zero or greater than zero

Holding Period Yield (HPY)

Now, to find return in percentage terms (more preferred by investors), there is a concept of HPY. This is the yield during the holding period.

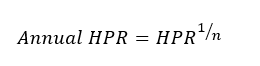

As HPY is the yield during the whole period of holding the asset, now to find the annual HPY

Where n = number of years the investment is held