Embarking on the fascinating journey of understanding capital allocation is akin to unlocking the secrets of how financial resources flow between those who have and those who need them. Transfers of capital between savers and those who need capital take place in three different ways. From the simplicity of Direct Transfers, where businesses connect directly with savers, to the orchestration of Investment Bankers in the primary market, and the vital role of Financial Intermediaries in creating new securities, this exploration promises to demystify the mechanisms that drive our financial world.

- Direct Transfers

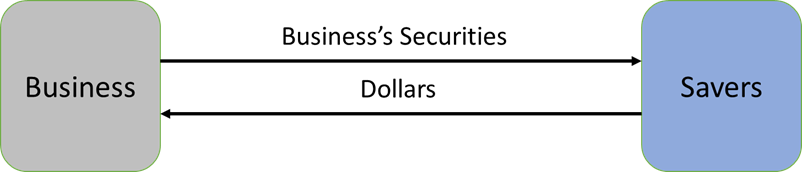

Money and securities move directly between a business (or government) and savers through direct transfers. In this process, the business sells its securities directly to savers, who, in return, provide the necessary funds. For instance, a privately held company could directly sell shares of stock to a new shareholder. Similarly, the U.S. government might engage in a direct sale of a Treasury bond to an individual investor. This straightforward transaction involves the business delivering its securities directly to the savers while receiving the required funds in exchange.

- Indirect Transfers through Investment Bankers

Indirect transfers can involve an investment banking house like Goldman Sachs, acting as an underwriter for the issuance. In this process, the underwriter acts as an intermediary, facilitating the issuance of securities. The corporation sells its stocks or bonds to the investment bank, which then sells these same securities to savers. As this transaction involves the introduction of new securities, and the corporation receives the proceeds from the sale, it is categorized as a “primary” market transaction.

- Indirect Transfers through a Financial Intermediary

In this scenario, the intermediary acquires funds from savers by offering its own securities. Subsequently, the intermediary utilizes these funds to acquire and retain securities from businesses. For instance, a saver could provide dollars to a bank, receiving a certificate of deposit in return. The bank might then lend this money to a small business, obtaining a signed loan in exchange. In this manner, intermediaries actively generate new types of securities through their financial operations.

Conclusion:

In the realm of capital allocation, the three pathways, each with their unique characteristics, collectively contribute to the dynamic nature of the financial ecosystem. From the straightforward exchange in Direct Transfers to the market dynamics orchestrated by Investment Bankers and the innovative securities generated by Financial Intermediaries, we’ve traversed the diverse terrain of capital allocation.