In the intricate landscape of financial metrics, Net Operating Profit After Taxes (NOPAT) stands as a pivotal indicator, offering insights into a company’s operational efficiency and profitability. Let’s embark on a journey to unravel the essence of NOPAT, exploring its significance and demystifying the steps involved in its calculation.

Understanding NOPAT: The Heartbeat of Operational Profitability

NOPAT is a critical measure that reflects a company’s profitability from its core operations, excluding the impact of taxes and other non-operating factors. Essentially, it provides a clear picture of the profit generated by a company’s operations before accounting for tax obligations.

Why NOPAT Matters: The Significance in Financial Analysis

NOPAT is a key player in financial analysis for several reasons. It serves as a fundamental metric for evaluating a company’s operational performance, allowing investors and analysts to assess how well the core business activities are contributing to overall profitability. By excluding the influence of taxes, NOPAT provides a purer reflection of a company’s ability to generate profits from its day-to-day operations.

For example, when comparing two companies with varying levels of debt leading to different interest charges, their operating performances might appear identical, yet their net incomes could differ significantly. A company carrying more debt would likely exhibit a lower net income. While net income is a significant metric, it may not always accurately portray a company’s operational performance or the efficacy of its management. A better measurement for assessing managerial performance is Net Operating Profit After Taxes (NOPAT). NOPAT represents the profit a company would achieve if it operated without any debt and held no financial assets, offering a clearer insight into the true operational efficiency and managerial effectiveness.

The NOPAT Calculation: Unveiling the Formula

Calculating NOPAT involves a straightforward formula:

NOPAT = Operating Income × (1 – Tax Rate)

Or

NOPAT = EBIT × (1 − Tax rate)

- Operating Income: This figure includes all the revenues and expenses directly associated with a company’s core operations. It excludes interest expenses and non-operational gains or losses.

- Tax Rate: The effective tax rate is applied to the operating income. It represents the proportion of the operating income that will be paid in taxes.

By multiplying the operating income by (1−Tax Rate), we obtain NOPAT—a clear representation of the profits generated from operations after accounting for taxes.

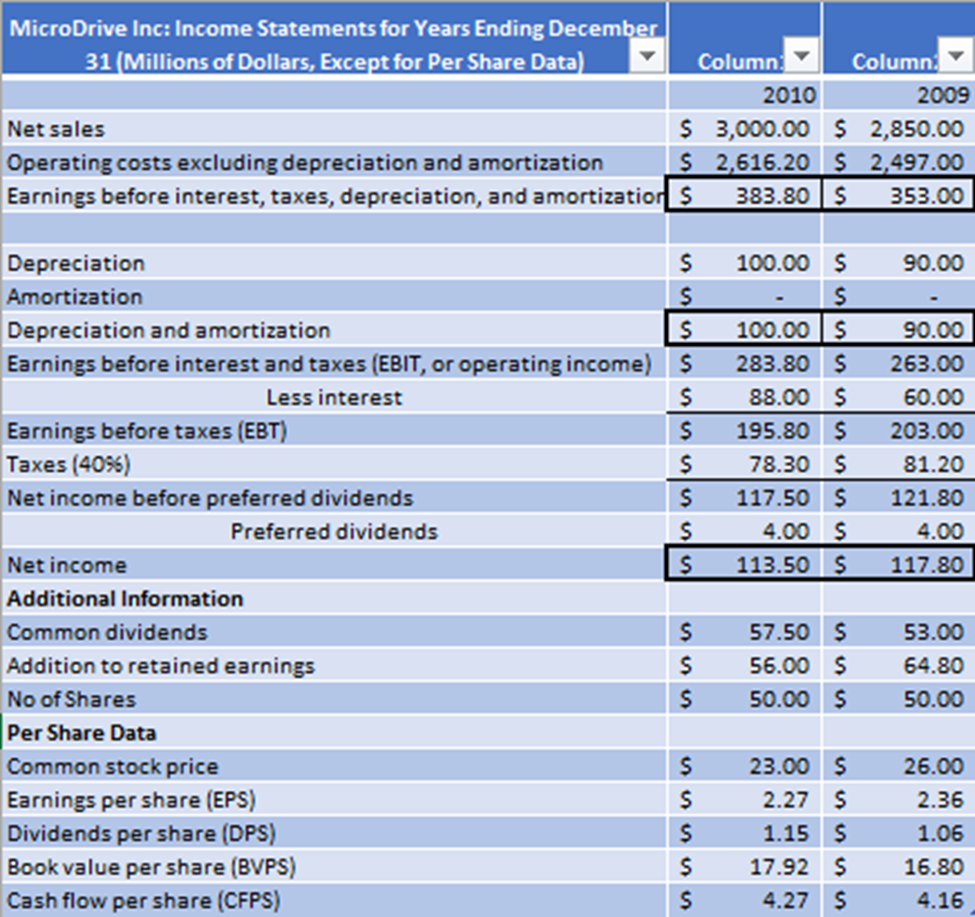

Let’s calculate NOPAT for MicroDrive Inc., consider the table below.

Using data from the income statements of Table, MicroDrive’s 2010 NOPAT is

NOPAT = 283.8(1-0.4) = 283.8(0.6) = 170.3 million

This means MicroDrive’s NOPAT is $170.3 million, a little better than its previous NOPAT of 2009 i.e., $263(0.6) = $157.8 million. However, the income statements in the Table show that MicroDrive’s earnings per share actually declined. So, it can be clearly seen that this decrease in EPS was because of an increase in interest expense, and not by a decrease in operating profit.

The Practical Insight: Interpreting NOPAT Results

Understanding NOPAT is only half the journey; interpreting the results is equally crucial. A positive NOPAT indicates that a company’s operations are profitable before taxes, while a negative NOPAT signals operational inefficiencies that need attention.

The Role of NOPAT in Financial Decision-Making

NOPAT is a valuable tool for both investors and corporate decision-makers. Investors use NOPAT to evaluate a company’s operational performance independently of its financing and tax structure. Meanwhile, within a company, NOPAT serves as a crucial benchmark for assessing the effectiveness of operational strategies and identifying areas for improvement.

Conclusion: Navigating Financial Clarity with NOPAT

In the realm of financial metrics, NOPAT emerges as a beacon, guiding analysts, investors, and businesses toward a clearer understanding of operational profitability. By demystifying NOPAT and comprehending its calculation, we empower ourselves to make informed financial decisions, navigate investment landscapes, and gauge a company’s true operational prowess. As we delve into the heart of NOPAT, let this exploration serve as a compass for unraveling the complexities of financial analysis and fostering a deeper appreciation for the metrics that drive sound financial strategies.