In the intricate world of financial management, where every metric holds significance, Net Operating Working Capital (NOWC) emerges as a crucial indicator, providing insights into a company’s operational efficiency and short-term financial health. Let’s embark on a comprehensive journey to unravel the intricacies of NOWC—what it is, why it matters, and how to accurately calculate this vital financial metric.

Understanding Net Operating Working Capital (NOWC):

Net Operating Working Capital is a financial metric that delves into the short-term operational liquidity of a business. It essentially represents the difference between a company’s operating current assets and its operating current liabilities, offering a nuanced perspective on how efficiently a company manages its day-to-day working capital. Many companies require current assets to facilitate their day-to-day operational functions. For instance, it is essential for all companies to maintain a certain amount of cash to facilitate various operational transactions. Companies regularly receive payments from customers and make payments to suppliers, employees, and others. Since the inflows and outflows of cash are not perfectly synchronized, it is necessary for a company to have a cash reserve in its bank account to ensure smooth operations. This applies not only to cash but also to other current assets like inventory and accounts receivable, all of which are crucial for routine operations. The term used for short-term assets utilized in a company’s operating activities is “operating current assets.” It’s important to note that not all current assets fall under this category. For example, the holdings of short-term securities are typically a result of investment decisions made by the treasurer rather than a natural outcome of operating activities. Consequently, short-term investments are classified as nonoperating assets and are usually excluded when calculating operating current assets.

A helpful guideline is that if an asset generates interest, it should not be categorized as an operating asset. Some current liabilities, especially accounts payable and accruals, arise as part of normal operational processes. These short-term liabilities are termed “operating current liabilities.” Like assets, not all current liabilities fall under this classification. For instance, consider the current liability represented as notes payable to banks. The decision to borrow from the bank could have been a financing choice, unrelated to operational necessities, as the company could have raised an equivalent amount through long-term debt or stock issuance. Again, the general rule is that if a liability incurs interest, it is not considered an operating liability.

If there is uncertainty about whether an item is an operating asset or liability, a useful question to ask is whether the item is a natural outcome of operations or a discretionary choice, such as a specific financing method or an investment in a particular financial asset. If it is a discretionary choice, then the item is not classified as an operating asset or liability. It’s worth noting that every dollar of operating current liabilities represents a dollar that the company doesn’t need to raise from investors to support its short-term operational activities. Therefore, net operating working capital (NOWC) is defined as operating current assets minus operating current liabilities. In other words, NOWC represents the working capital acquired using funds from investors.

The Components of NOWC:

To comprehend NOWC, we need to dissect its components:

- Operating Current Assets: These include current assets directly tied to a company’s operations, such as cash, accounts receivable, and inventory.

- Operating Current Liabilities: On the flip side, operating current liabilities encompass short-term obligations related to a company’s operations, like accounts payable and accrued expenses.

The Significance of NOWC:

NOWC provides valuable insights into a company’s ability to meet its short-term obligations using its operational resources. A positive NOWC indicates that a company has ample working capital to cover its short-term liabilities, reflecting sound financial health.

Calculating Net Operating Working Capital:

The formula for calculating NOWC is straightforward:

NOWC = Operating Current Assets – Operating Current Liabilities

Accurate calculation involves identifying the specific components of operating assets and operating liabilities, ensuring a precise representation of a company’s operational liquidity.

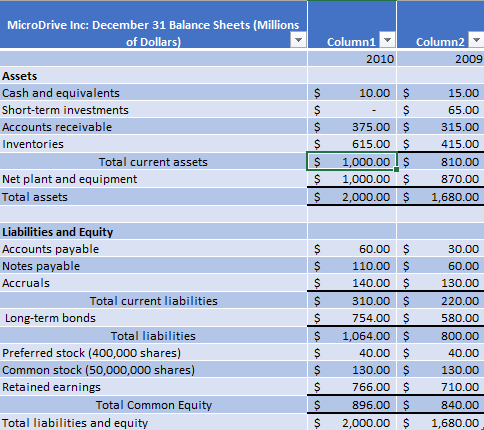

We can apply these definitions to MicroDrive, using the data given in the balance sheet above. Here is its net operating working capital at year-end 2010:

NOWC = Operating current assets – Operating current liabilities

NOWC = (Cash + Accounts receivable + Inventories) – (Accounts payable + Accruals)

NOWC = ($10 + $375 + $615) – ($60 + $140)

NOWC = $800 million

For the previous year, net operating working capital was

NOWC = ($15 + $315 + $415) – ($30 + $130)

NOWC = $585 million

Why NOWC Matters:

- Operational Efficiency: NOWC is a barometer of how efficiently a company manages its operational resources. A well-managed NOWC ensures that a business has the necessary liquidity to sustain day-to-day operations.

- Cash Flow Management: Monitoring NOWC aids in effective cash flow management, allowing businesses to optimize their working capital and allocate resources judiciously.

- Investor Confidence: Investors often scrutinize NOWC to gauge a company’s ability to handle short-term obligations. A positive NOWC can instill confidence in investors regarding a company’s financial stability.

Conclusion: Navigating Financial Health with NOWC:

In conclusion, Net Operating Working Capital stands as a crucial metric in the financial toolkit, offering a nuanced perspective on a company’s short-term operational efficiency. By understanding its components, calculating it accurately, and recognizing its significance, businesses can navigate the complex terrain of financial management with greater precision. NOWC not only serves as a vital indicator of financial health but also empowers decision-makers to make informed choices for sustainable business growth.